Executive Summary

Africa’s carbon market presents a compelling “triple win” opportunity for climate action, economic development, and social benefits. Despite global market volatility, Africa has demonstrated remarkable resilience, with 11% growth in demand, representing only 16% of the global carbon market. This growth has the potential to produce up to 2,400 MtCO2e of carbon credits by 2030. This analysis, informed by Business and Society frameworks, identifies key implementation pathways across regulatory infrastructure, digital systems, and sector-specific strategies. Recent developments from COP29’s Article 6 implementation guidelines and the EU’s Carbon Border Adjustment Mechanism now create additional urgency and opportunity (UNFCCC, 2024). Success hinges on striking a balance between market integrity and community benefits through robust monitoring systems, regional coordination, and alignment with sustainable development. Critical next steps include harmonising national carbon pricing policies, strengthening verification mechanisms, and expanding the financial architecture to position Africa as a leader in the global transition to low-carbon economies while addressing its unique development imperatives.

Introduction

Nigeria, with its rapidly growing population and The global urgency to address climate change has underscored the importance of carbon markets as essential tools for facilitating green transitions, particularly in developing regions such as Africa. Drawing on Business and Society frameworks, this analysis examines how market mechanisms can address the fundamental environmental externality where the social costs of carbon emissions exceed the private costs borne by emitters—a market failure that demands policy intervention.

Three primary policy approaches have emerged globally: price-based mechanisms (such as carbon taxes), quantity-based approaches (such as capand-trade systems), and direct regulations that mandate specific standards. While theoretical frameworks suggest possibilities for private Coasian solutions through direct stakeholder negotiations, practical implementation faces barriers including high transaction costs, unclear property rights, and collective action challenges across jurisdictions (Business & Society, INSEAD, Roulet 2025).

These limitations necessitate government intervention, as demonstrated by initiatives like the EU Emissions Trading System and its evolving Carbon Border Adjustment Mechanism, which entered its implementation phase in 2024 with direct implications for African exports (World Bank, 2024).

Africa’s carbon market has shown remarkable resilience despite global fluctuations, achieving 11% growth in demand while experiencing only a 1% decrease in supply over the past year (ACMI, 2024). This contrasts with the global market’s 22% reduction in demand during the same period. The continent’s current 16% representation in global carbon markets belies its vast potential, estimated at 2,400 MtCO2e of carbon credits by 2030. This analysis examines the specific challenges and opportunities in developing carbon markets across Africa, balancing theoretical foundations with practical implementation realities.

Analytical Framework: Business & Society Approach

The Business and Society framework provides a valuable lens for understanding the implementation of carbon markets in Africa. At its core, environmental externalities represent a market failure where businesses do not bear the full social costs of their emissions, creating a gap between private and social costs. While government interventions through carbon taxes, cap-and-trade systems, or direct regulations can bridge this gap, effective implementation requires careful consideration of economic realities, particularly in developing regions.

The Business and Society framework provides a valuable lens for understanding the implementation of carbon markets in Africa. At its core, environmental externalities represent a market failure where businesses do not bear the full social costs of their emissions, creating a gap between private and social costs. While government interventions through carbon taxes, cap-and-trade systems, or direct regulations can bridge this gap, effective implementation requires careful consideration of economic realities, particularly in developing regions.

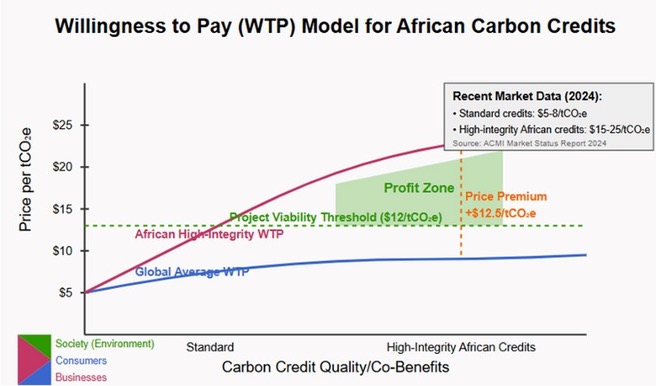

Furr, Atasu, and Cool’s (2025) “triple win” framework effectively captures the opportunity for African carbon markets to simultaneously benefit society through emissions reduction, provide consumers with sustainable products, and create new revenue streams for businesses. This framework highlights how sustainability initiatives can create value rather than merely adding costs when properly structured.

The economic viability of African carbon markets hinges on increasing willingness to pay (WTP) for highquality carbon credits. As Furr et al. (2025) explain, “even if just a segment of the market is willing to pay more for the more sustainable product, this can be sufficient for the company to achieve a triple win.” This principle applies directly to African carbon markets, where high-integrity credits with co-benefits can command premium pricing. When the increase in WTP is significant enough, profits can exceed prior levels, “making the sustainable innovation economically worthwhile for the business” (Furr et al., 2025).

As illustrated in Figure 1 below carbon markets can simultaneously benefit society through emissions reduction, provide consumers with sustainable products, and create new revenue streams for businesses.

Implementation Analysis: African Carbon Market Development

3.1 Current Market Status and Progress

Africa’s carbon market infrastructure is developing through several concrete initiatives. Seven countries are actively developing comprehensive frameworks for carbon trading, with over $1 billion in commitments secured for purchasing African carbon credits. More than 100 highintegrity carbon credit projects have been established across 25 countries, demonstrating the continent’s capacity for quality implementation (ACMI, 2024). Kenya made significant progress in 2024 with the launch of its carbon exchange, while South Africa’s carbon tax has evolved toward potential market linkages (Climate Policy Initiative, 2024). These developments are further strengthened by integration with Carbon Border Adjustment Mechanism requirements established in recent international agreements.

3.2 Implementation Challenges and Solutions

Carbon market implementation in Africa faces two competing priorities requiring careful balance: market integrity and community benefits. Market integrity challenges include developing robust monitoring, reporting, and verification (MRV) systems that meet international standards while remaining accessible to African project developers. The Voluntary Carbon Market Integrity Initiative’s 2024 standards update has raised benchmark requirements, creating both challenges and opportunities for African markets (VCMI, 2024). Solutions include implementing training and certification programs for local practitioners, creating transparent fund distribution mechanisms, and harmonizing national carbon pricing policies to prevent regulatory arbitrage.

Community benefits and sustainable development represent the second crucial implementation challenge. Successful carbon markets must demonstrate tangible contributions to development goals through job creation, improved health outcomes, enhanced climate resilience, biodiversity protection, and fair benefit-sharing mechanisms. According to the IEA’s Africa Energy Outlook (2024), carbon finance could mobilize up to $18 billion annually for clean energy access projects by 2030 if properly structured. Failure to deliver these co-benefits risks undermining local support and long-term sustainability of carbon projects.

Technical implementation barriers include limited digital infrastructure in rural areas, insufficient standardization of measurement methodologies, and high verification costs for smaller projects. Successful implementation requires investment in technological solutions adapted to African contexts, such as mobile monitoring applications, satellite verification systems, and aggregation mechanisms for small-scale projects. Recent advances in satellite monitoring technology have reduced verification costs by 37% for forest carbon projects since 2022 (McKinsey, 2024).

3.3 Sector-Specific Implementation Strategies

Energy Sector

Africa’s energy sector presents distinctive implementation opportunities through renewable energy projects focused on local needs. Implementation strategies should prioritize grid modernization alongside stability improvements to accommodate intermittent renewable sources. Rural electrification through clean energy solutions offers potential for both emissions’ reduction and development benefits. Implementation success requires addressing financing barriers through blended finance approaches, capacity building for local maintenance, and policy frameworks that enable distributed generation.

Agriculture and Land Use

Agricultural and land use projects represent Africa’s largest potential carbon market segment but face complex implementation challenges. Successful implementation requires developing standardized methodologies for soil carbon measurement appropriate for diverse African agricultural systems. Reforestation and conservation projects must balance carbon sequestration with community access to forest resources. Implementation should prioritize capacity building for smallholder farmers, transparent benefit-sharing mechanisms, and integration with existing agricultural extension services.

Industrial Development

Industrial sector implementation requires balancing emissions reduction with economic growth imperatives. Clean technology adoption can be accelerated through targeted financial incentives, technology transfer programs, and demonstration projects. Energy efficiency improvements often offer cost-effective “early wins” while building implementation capacity. Circular economy approaches can simultaneously reduce emissions and create new economic opportunities. Implementation should focus on sectors with high mitigation potential and development benefits, such as cement, steel, and manufacturing.

Policy Recommendations

Based on this analysis, the following actionable recommendations would strengthen carbon market implementation across Africa:

For African Governments:

- Establish clear carbon pricing policies with predictable price floors to reduce investor uncertainty.

- Develop streamlined approval processes with one-stop shops for carbon project developers.

- Integrate carbon market objectives into national development plans and NDCs.

- Invest in digital infrastructure for transparent monitoring and verification.

- Create capacity-building programs targeting project developers, verifiers, and regulators.

For International Partners:

- Provide technical assistance focused on regulatory harmonization across African nations

- Support development of Africa-specific methodologies that balance rigor with accessibility.

- Create blended finance vehicles to reduce early-stage project risks, building on the Climate Finance Mobilization Framework adopted at COP29 (UNFCCC, 2024).

- Recognize Africa’s unique development context in international carbon market frameworks, particularly in Article 6 implementation guidelines.

- Invest in long-term capacity building rather than short-term project implementation, with at least 40% of support directed to institutional strengthening (World Bank, 2024).

For Private Sector Participants:

- Develop project pipelines aligned with national development priorities.

- Invest in community engagement and benefit-sharing mechanisms.

- Contribute to standardization of methodologies and best practices.

- Build partnerships with local institutions to enhance implementation capacity.

- Commit to transparent reporting and independent verification.

Implementation Timeline:

- Immediate (2024-2025): Establish regulatory frameworks and registry systems in leading countries.

- Medium-term (2025-2027): Develop regional coordination mechanisms and harmonized standards.

- Long-term (2027-2030): Scale successful models across the continent while maintaining quality.

Conclusion

Implementing carbon markets in Africa represents more than a climate action policy—it demonstrates how market mechanisms can drive sustainable development while contributing to global climate goals. As the world navigates uncertain times in climate policy, Africa’s progress in voluntary carbon markets offers valuable lessons for balancing environmental integrity with development needs.

The initiative’s alignment with global carbon market developments and climate finance goals positions it as a potential model for other regions implementing similar transitions. Success will require continued commitment to market integrity enhancement, sustained capacity building, effective stakeholder engagement, regional coordination strengthening, and integration with international climate finance mechanisms.

The next 24 months are crucial for determining whether Africa can become a major player in global carbon markets (ACMI, 2024). The foundation exists through demonstrated market resilience and growing institutional support. With appropriate implementation strategies, African carbon markets can deliver the “triple win” of environmental protection, economic development, and social benefits—transforming climate action from a cost into an opportunity for sustainable growth.

References

- ACMI. (2024). Africa Carbon Markets: Status and Outlook Report 2024-25. Africa Carbon Markets Initiative. Retrieved from https://africacarbonmarkets.org/

- African Development Bank (AfDB). (2024). Climate Finance in Africa: Annual Report 2024. African Development Bank Group.

- Climate Policy Initiative. (2024). Global Landscape of Climate Finance: Africa Focus. CPI Report.

- Furr, N., Atasu, A., & Cool, K. (2025, March 6). The Economics of Sustainability. INSEAD Knowledge.

- International Energy Agency (IEA). (2024). Africa Energy Outlook 2024. IEA Publications.

- McKinsey & Company. (2024). The Future of Africa’s Carbon Markets: Growth Pathways and Investment Opportunities. McKinsey Global Institute.

- UNFCCC. (2024). Outcomes of the Glasgow–Sharm el-Sheikh–Dubai–Baku Work Programme on Nationally Determined Contributions (NDCs). United Nations Framework Convention on Climate Change.

- Voluntary Carbon Market Integrity Initiative (VCMI). (2024). Claims Code of Practice: 2024 Update. VCMI.

- World Bank. (2024). State and Trends of Carbon Pricing 2024. World Bank Group, Washington, DC.